FATF Grey List status for Pakistan is once again at the center of global attention, as India intensifies its diplomatic and financial measures in the wake of the tragic Pahalgam terror attack. The incident, which resulted in the death of 26 individuals—mostly tourists—has rekindled calls for stricter international monitoring of Pakistan’s financial activities. India is now formally advocating for Pakistan’s re-entry into the Financial Action Task Force (FATF) grey list, citing serious lapses in the country’s commitment to counter-terrorist financing.

The FATF and Its Purpose

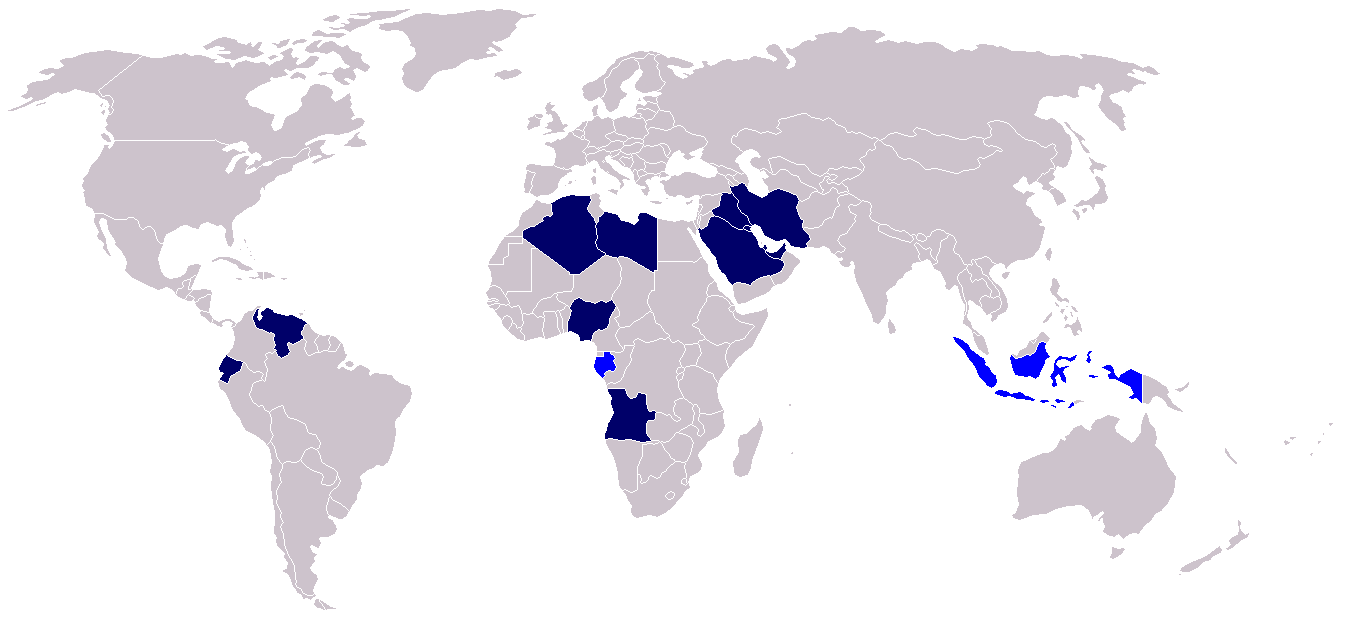

The Financial Action Task Force (FATF) is an inter-governmental body established in 1989 during a G-7 summit in Paris. Originally aimed at combating money laundering, its mandate expanded post-9/11 to include terrorist financing and, more recently, the proliferation of weapons of mass destruction (WMDs).

India, an observer of FATF since 2006 and a full member since 2010, has consistently pushed for stringent global norms to deal with terrorism financing—especially from countries in its neighborhood. FATF works by identifying high-risk countries and placing them on a “grey list” (under increased monitoring) or “black list” (non-cooperative jurisdictions).

Why the FATF Grey List Matters

Being placed on the FATF grey list has significant financial and geopolitical consequences. Countries on this list face:

- Increased scrutiny from global financial institutions like the IMF, World Bank, and the Asian Development Bank.

- Restrictions on accessing global financial markets.

- Loss of investor confidence, which hampers foreign direct investments (FDI) and loans.

Pakistan was on the grey list from 2018 to 2022. It was removed after promising to meet FATF’s 34-point action plan focused on anti-money laundering (AML) and counter-terrorist financing (CFT) frameworks.

However, with the resurgence of violent extremism, India argues that Pakistan has not truly reformed but only complied on paper to evade penalties.

India’s Push After Pahalgam Attack

India is using the momentum generated by the Pahalgam attack to re-engage with key FATF member nations such as the United States, France, Germany, and the United Kingdom. It aims to build consensus for re-listing Pakistan on the FATF grey list during the upcoming plenary meeting.

Indian intelligence has reportedly presented evidence of financial channels and terror infrastructure operating with impunity in Pakistan. By leveraging the FATF framework, India seeks to expose and restrict these funding pipelines.

Diplomatic and Financial Implications

Placing Pakistan back on the FATF grey list would send a strong message. It not only pressures Islamabad to take verifiable action against terror outfits but also serves as a non-military tool in India’s foreign policy arsenal.

This move comes at a sensitive time for Pakistan, as it has recently secured a critical bailout from the IMF. Re-listing would likely complicate future negotiations and put its fragile economy at further risk.

Moreover, the FATF grey list designation can strain bilateral relations, curtail foreign aid, and limit international trade partnerships—thus isolating the country diplomatically and financially.

Regional Security and International Trust

The FATF grey list is not just about economic sanctions; it is about restoring international trust in a country’s financial and regulatory institutions. India contends that Pakistan’s removal from the grey list was premature, and that meaningful actions—not just legislative changes—are necessary.

By urging FATF to reconsider Pakistan’s status, India is aligning with global efforts to create financial accountability in counter-terrorism operations. It also demonstrates how financial instruments are increasingly used to address global security concerns.

Looking Ahead: The FATF Plenary and Global Response

The next FATF plenary session will be closely watched. If member states are convinced by India’s evidence and diplomatic efforts, Pakistan may find itself once again under intense global scrutiny.

For India, this development could be a major diplomatic win, showing its resolve not only in combating terrorism but also in using international platforms effectively.

Whether or not Pakistan is re-listed, the situation underscores the evolving relationship between financial compliance and international security in today’s geopolitical landscape.

Conclusion

India’s move to seek the FATF grey list re-entry for Pakistan post-Pahalgam attack marks a significant step in using financial diplomacy to combat terrorism. The outcome of this initiative could reshape regional alliances, redefine counter-terrorism strategies, and reinforce the role of FATF as a critical tool in ensuring global peace and security.